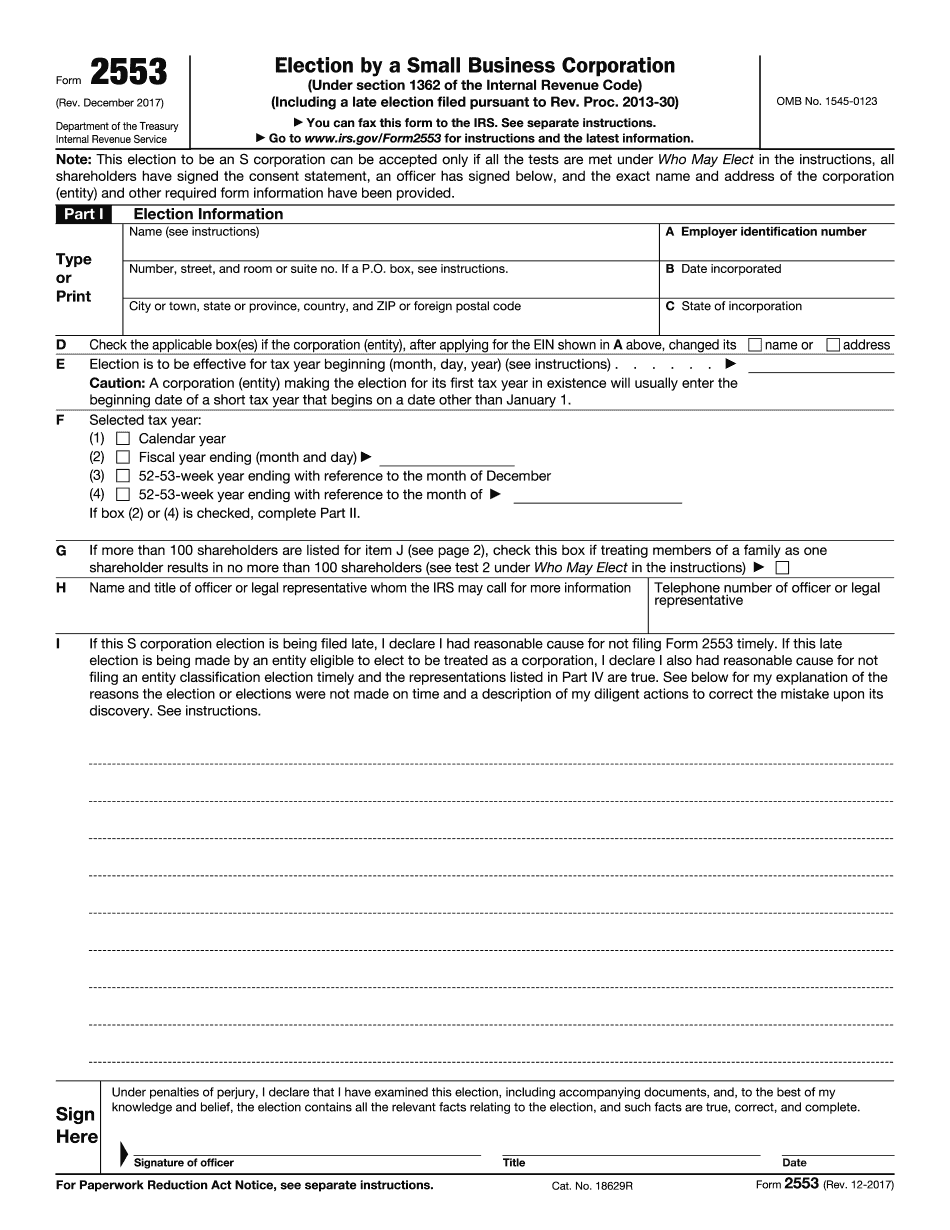

Howdy everybody! Justin here, chapter one of what I hope to be many more chapters on educational content regarding the tax and financial function of your business. Today, we will be discussing the beginning stages of forming a corporation, obtaining an identification number, and filling out the S election form for the corporation to be treated as a flow-through entity, specifically form 2553. I will keep this explanation concise, simple, and accessible for everyone, assuming that you all reside in the state of New York and have no prior knowledge on the topic. My goal is to provide you with the confidence to handle these tasks on your own, without having to spend excessive amounts of money on legal or accounting fees. In fact, I am quite confident that you can complete these steps for less than $200 by following my tutorial video, referring to the accompanying images, and perhaps reaching out to me with any questions. To begin, I will include a direct link in the comment section below, leading you to the website of the New York Division of Corporations. Although this may not be the specific website for your state, let's assume it is for now. Click on the link to access the webpage where you can fill out the necessary information for forming a corporation. The only details required are the name of your corporation, which will be checked for availability, as well as some basic information about your business such as the address and your social security number. In the next few seconds, you will see some official approved documentation that supports a core assignment. This can be used as a cheat sheet, as it accurately represents how the online form should be filled out. Please note that I personally submitted my application manually, but it was still...

Award-winning PDF software

2553 instructions 2025 Form: What You Should Know

C) allows the IRS to use Schedule D to make an election on a single Form 1040, 1040A or 1040EZ if: 1. The S corporations (or LLC's) is organized in a state that has its own rules for S corporation elections, or 2. The S corporations elect to use Form 2553. In case of any other tax-related situation, Schedule D will simply list the information already on an IRS form that has already been filed. Here's some information that might help fill out the form: A business entity can be a corporation, partnership, limited liability company, partnership or S corporation. A sole proprietorship is treated as an S corporation if it: a) has no employees, and b) has a sole member who is a shareholder of the LLC, and c) operates only for profit. A partnership is treated as a partnership where a partner meets the following requirements: i. is not a shareholder of the partnership, and ii. is not a taxpayer. LLC's, S corps, and LPs that are sole proprietors and have gross income from an unrelated trade or business of 500000 or less are not taxed as a corporation.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Steps to Complete 2553 IRS , steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Steps to Complete 2553 IRS online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Steps to Complete 2553 IRS by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Steps to Complete 2553 IRS from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 2553 instructions 2025