P>Hey now, two companions asked the angel if they wanted anything. This is by Tim and one of them said, "hop back on here really quick just to talk about dependence." That is the question on everyone's mind - can I claim my dependent as my mom or my dad? Can I claim my sister, my aunt, my niece, or my uncle? Mind you, this can become a really long list. Are those people that I can claim? We're going to do another separate video that kind of breaks down dependency and the test that needs to be met in order to claim a dependent. Okay, so with that being said, let's just talk a little bit about the baby mama baby daddy drama that goes on. I want to inform everybody about a form, now this form may not be known by everyone, but there are some people out there who already have this jargon in a divorce decree or a court child custody judgment or whatever you may have. Basically, it's called form 8332, which is called the release or relocation of a child exemption by a custodial parent. This form is important for everyone to know about, especially if you are at odds with your ex-wife or your current wife who let you cheat on her and now wants to claim all of your kids and her kids. I know there are a lot of messy situations out there. So I will say this, at the end of the day, you will have to file a paper return. There's no other way around it. You have to file a paper return. But when you file the paper return, hopefully you will have this form on your person and you can have a conversation with whoever is taking...

Award-winning PDF software

Where to file 8832 Form: What You Should Know

Which place to send the tax return form for business in? Do you need a physical form to file? Which state does not require Form 8832 of self-employment? The federal return, for tax purposes, is considered a “return of any business” for purposes of filing Form SSA with your state/federal/district tax authority. However, if the business entity is a Foreign corporation, partnership, individual, or LLC or S-corporation, for tax purposes, the business entity itself would be considered to be a “receipt”, not a Return of any business entity, even if the entity qualifies as a “business entity” for federal filing purposes. Form 8832: Tax Return Form SSA-T (Form 8832): Self-Employment Tax Return (Form SSA-T) — IRS The IRS has a separate guide, Form SSA-T (Form 8832), for self-employment tax return information. See the page on “Form SSA-T” for more Tax forms: Where to file for each federal filing form for business or self-employment. Form 8920 (PCT) — U.S. Dept of Labor; Form 8920-A (Self-Employment Dependent Return) — IRS Form 8920 (PCT) — U.S. Dept of Labor; Form 8920-A (Self-Employment Dependent Return) — IRS The U.S. Dept. of Labor requires that self-employment income be reported annually, in the same form, for tax purposes. Form 1040 and Forms 1040A or 1040EZ (Filer's Statement): The U.S. Dept. of Labor requires taxpayers who have annual self-employment income reporting to report on each of these tax forms by April 15. Filing Schedule A: A Business Income Tax Return — IRS The IRS requires a quarterly reporting of business income. Business income is defined as compensation for services, other than tips, wages, and salaries. The IRS will determine the method of reporting by using Form 1040X and Form 1040A (the return) to apply income taxes, social security taxes, and Medicare taxes from the previous year as income. The IRS will compute the tax by taking into account the amounts shown in Schedule D, line 12b, in computing estimated tax for the next tax year.

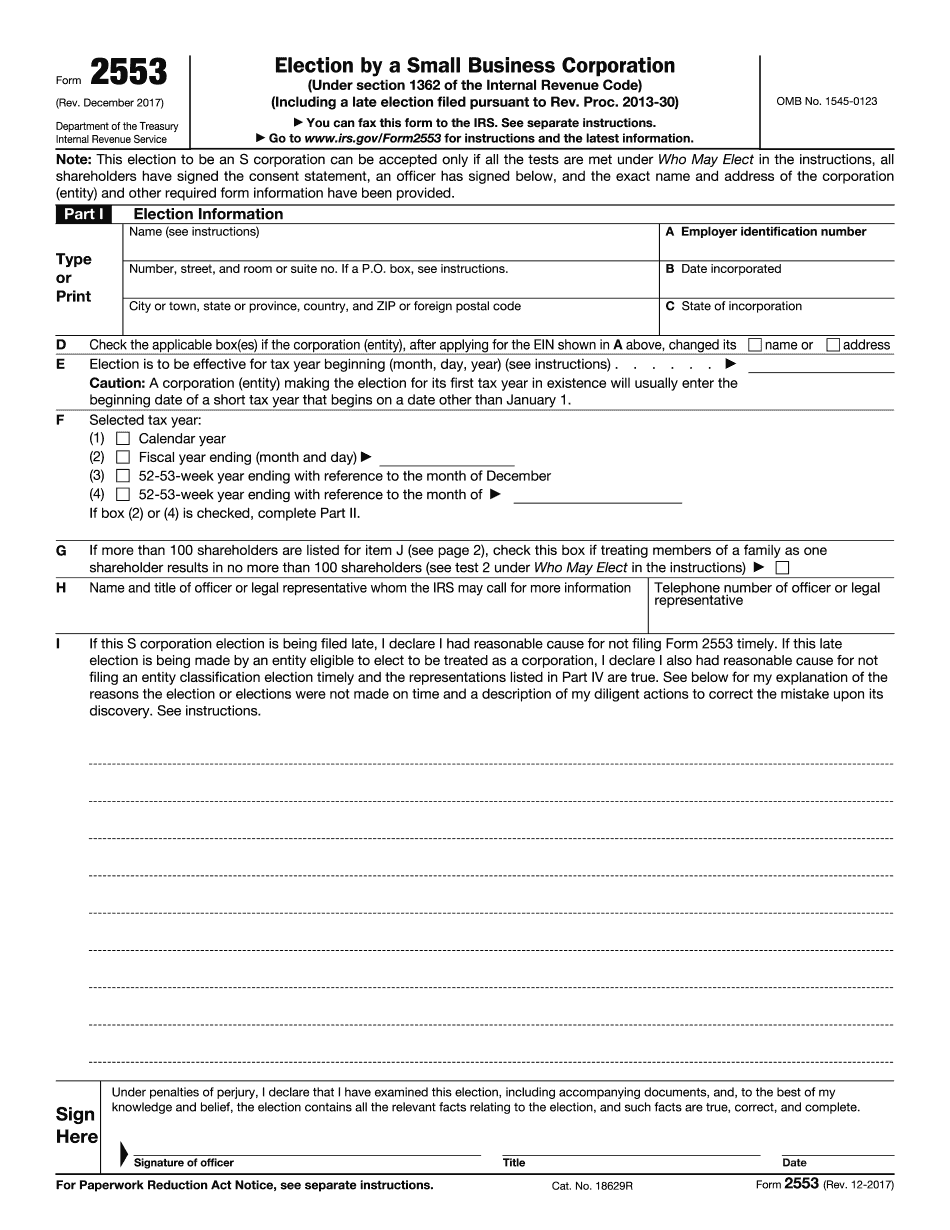

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Steps to Complete 2553 IRS , steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Steps to Complete 2553 IRS online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Steps to Complete 2553 IRS by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Steps to Complete 2553 IRS from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Where to file form 8832