Award-winning PDF software

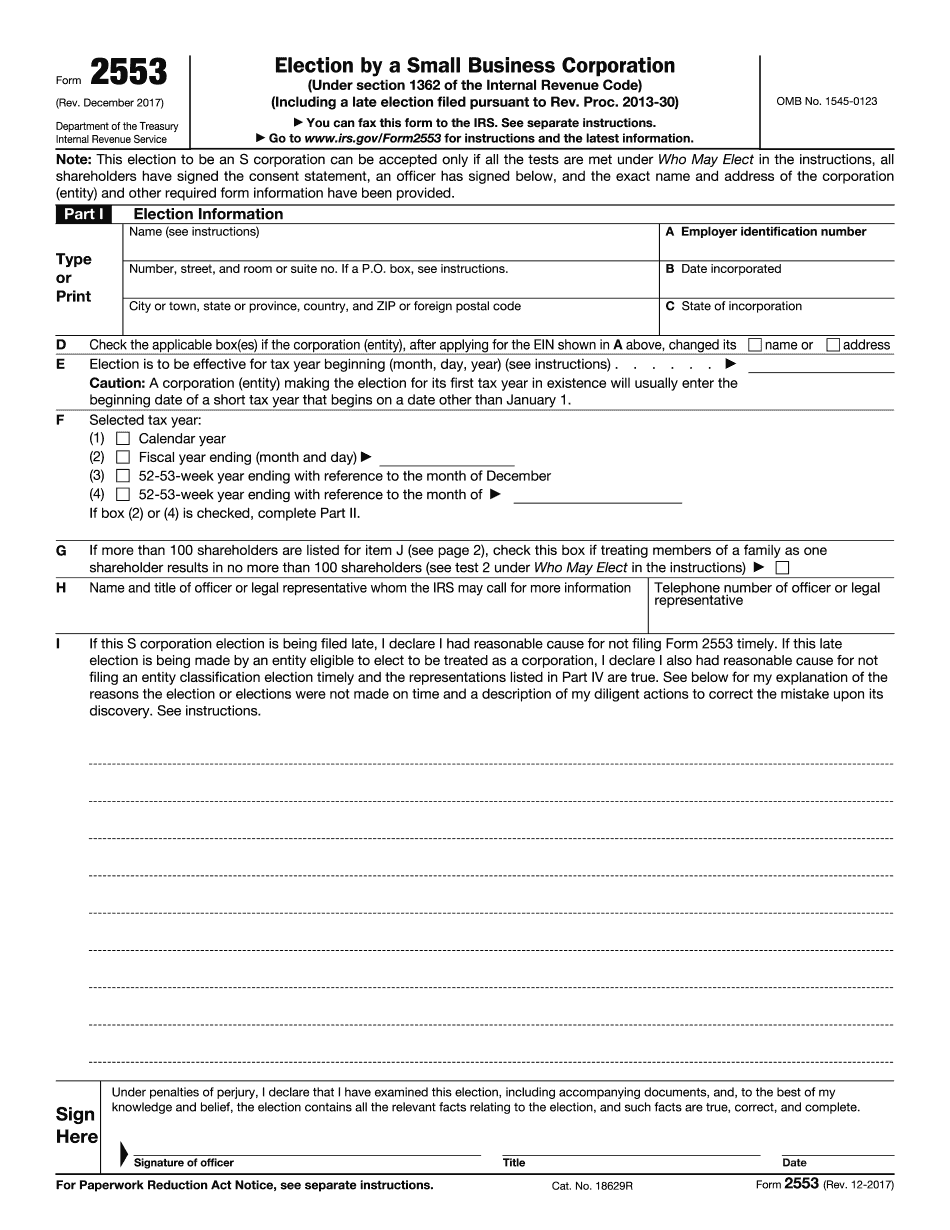

How late can you file an S Corp Election Form: What You Should Know

Late Election Relief | Internal Revenue Service Nov 23, 2025 — It would take 2 or more years to file as an S corporation · The IRS provides a special deadline for the late election which will not apply to the filing of Form 2553 (or Forms 1040), 1059, or W-2G as an S corporation. The special deadline is based on the fiscal year for which the election is filed. If this deadline is reached in any tax year, Election Deadline will be increased by an additional 15 days. The 15-day extension applies to the first taxable year in which the election is filed and will not apply to the taxable year in which Form 2553 (or Forms 1040, 1059, or W-2G) is filed. If Election Deadline is reached in tax year 1 and the election is approved in tax year 2, the IRS will apply a 40-day extension to tax year 2, even though the first taxable year in which the election is filed did not pass when it was extended. Note that an S corporation election does not affect the 10% earliest-acquired stock bonus limit. Form 2553 or 1094 Form 2553 for U.S. Shareholders Filing as a Shareholder in a Foreign Corporation Election If your tax return is based in a foreign jurisdiction, the S corporation election process needs to be followed for the purpose of determining U.S. estate or gift tax treatment. When to File the Election An S corporation election filed within 2 years of your original tax return filing will be treated as timely filed if filed within six months of the close of your fiscal year and Form 2553 or Forms 1040, 1059, 1095, or W-2G is issued to you. How to File an S Corp Election Late You can file the election at any time with an IRS office that is located within the country in which you reside. Late Election Relief | Internal Revenue Service Nov 23, 2025 — There is a special election deadline when filing S corporation elections if the election could apply to taxable foreign years beginning after the election was filed. • The extension provided for an S corporation election does not apply to the filing of Form 2555, as an election relating to an unqualified retirement plan, or the filing of a Form 5498, as an election relating to a tax shelter transaction.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Steps to Complete 2553 IRS , steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Steps to Complete 2553 IRS online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Steps to Complete 2553 IRS by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Steps to Complete 2553 IRS from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.