Hi I'm Betty hock Berger CPA in Hollywood Florida, and today I'm going to walk you through preparing the form two five three to make the S corp election, so this is the IRS form two five three election by a small business corporation otherwise known as an S corp there's a couple of pages to this form, but you're really only going to look at the first two pages most likely so let's scroll back up to the top so here you've got the name and this should be the business name that you registered with both your state and with the IRS, so I'm just going to make up this information for argument's sake here ABC corporation and Inc and you should have also gotten an identification number as part of setting up your business, and again I'm going to make this number up and all this needs to match, so it needs to match the state information it needs to match the IRS and federal information otherwise you're going to have problem paperwork problems when you submit this and the date incorporated again this is going to match your state information your state okay now if you want to change the name or address you can click these boxes but for now we're just going to use information and say that it matches what we already filed, so this is where you're going to pick the effective date and there are some rules as to when you are going to have your s selection go in place generally it's either going to be the date that you started business if it's a brand-new business, or it's going to be the beginning of the next year so if you are in your second third or fourth year business,...

PDF editing your way

Complete or edit your form 2553 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export irs form 2553 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 2553 s corp as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your form 2553 irs by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Steps to Complete 2553 IRS

About Form Steps to Complete 2553 IRS

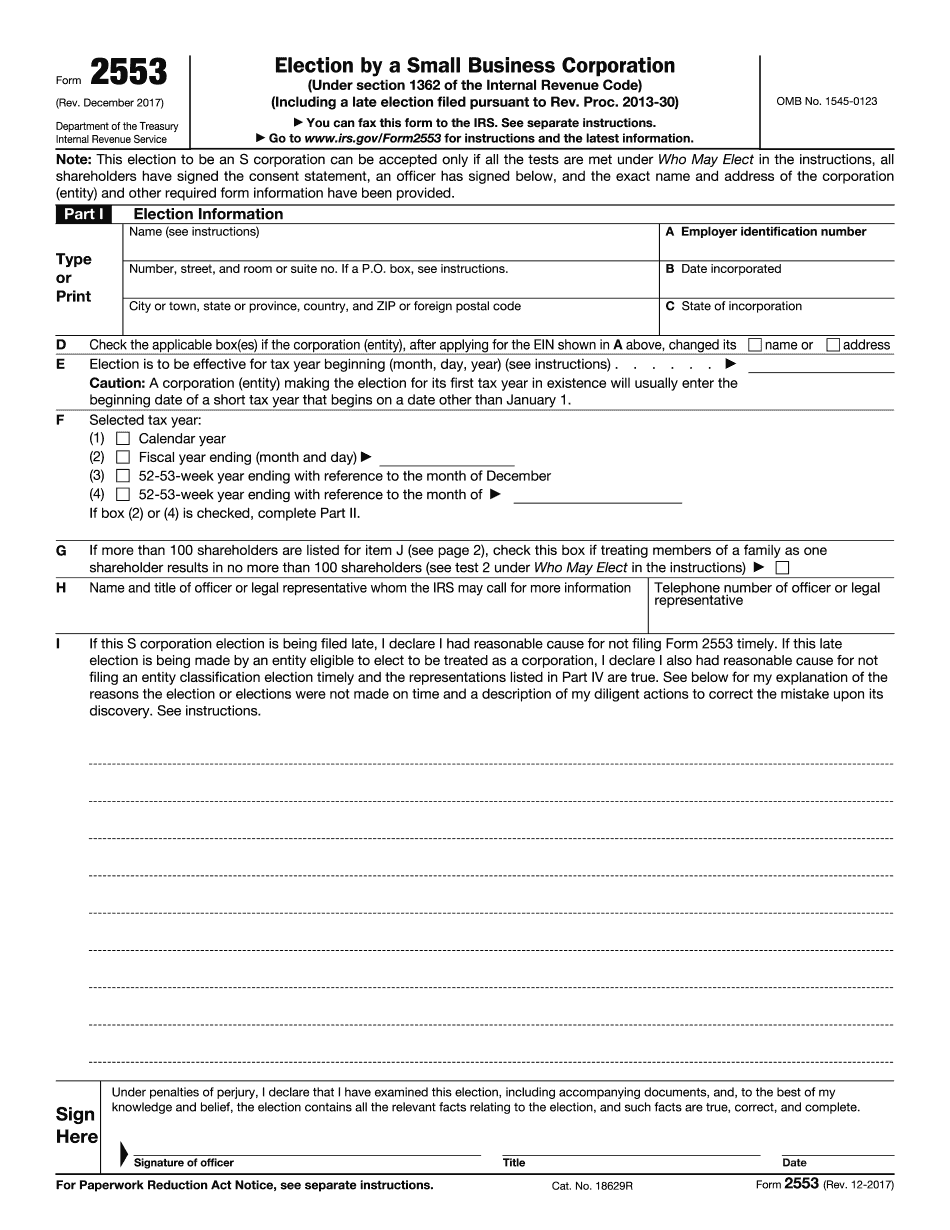

Form 2553 is the application for making an S corporation election. It is used by eligible corporations to elect to be taxed as an S corporation in the United States. The form includes a series of steps that must be completed before submitting it to the Internal Revenue Service (IRS). Step 1: Check eligibility To qualify for S corporation status, a corporation must meet certain requirements, such as having no more than 100 shareholders and only issuing one class of stock. The corporation should check its eligibility before proceeding with the form. Step 2: Fill out the form The corporation needs to complete the form by providing details like its name, address, employer identification number (EIN), and the date it wants the S corporation election to become effective. Step 3: Obtain signatures All shareholders of the corporation must sign the form, indicating their agreement with the S corporation election. Any shareholder who is unable to sign must provide a written statement. Step 4: Submit the form The corporation should send the completed and signed form to the IRS, along with any required tax payments, by the due date of the election. Who needs it? Any eligible corporation that wishes to be taxed as an S corporation must complete Form 2553 and submit it to the IRS. This applies to corporations already in existence that wish to change their tax status as well as new corporations that wish to elect S corporation status when they are formed.

Steps to Complete 2553 Irs Form

Organizations that elect to be taxed under the S Subchapter of Chapter 1 of the Internal Revenue Code have to prepare 2553 Form, Election by a Small Business Corporation. In this way, S corporations’ income and losses pass through to the shareholder owners and are taxed on their individual income tax returns.

Visit our website to get editable and printable blanks to fill out Irs 2553 form in a matter of minutes. Sign the document electronically by typing, drawing or uploading your signature from any internet-connected device. Download the completed 2553 Form in the PDF format to your device and forward to the recipient via email, fax or sms. Stay focused on your primary tasks by exploring how to create the document online.

Read carefully the instruction given below and pronly truthful and complete information.

- In Part 1 prthe identifying data, i.e. the name and address of your business, employer identification number, date and state of incorporation.

- In Box E write the effective date of the election.

- Choose your tax year in Box F.

- In case you have 100 shareholders and aggregating family members indicate this in Box G.

- Specify the name, title and phone number of a contract representative in Boxes H and I.

- Sign and date the document on page 1.

- The second page is intended for the shareholder election information. Prnames, addresses, social security numbers, ownership percentage and end of the taxpayer’s year for each shareholder.

- Part II and III on page 3 are optional. Learn whether you need to deal with this sections.

Once the 2553 Form is completed, send it to the recipient. If necessary, print out the blank and fill it out by hand to bring personally.

Online remedies aid you to arrange your document administration and strengthen the productivity of your respective workflow. Go along with the short guide to carry out Form Steps to Complete 2553 IRS, avoid glitches and furnish it inside of a well timed fashion:

How to finish a Form Steps to Complete 2553 IRS over the internet:

- On the website with the type, click Get started Now and move with the editor.

- Use the clues to complete the pertinent fields.

- Include your individual details and call knowledge.

- Make convinced you enter right data and quantities in acceptable fields.

- Carefully look at the written content of your sort also as grammar and spelling.

- Refer to help segment in case you have any thoughts or deal with our Guidance workforce.

- Put an electronic signature on your own Form Steps to Complete 2553 IRS together with the guide of Indication Software.

- Once the form is accomplished, push Finished.

- Distribute the ready sort via e mail or fax, print it out or save on your product.

PDF editor lets you to make alterations to your Form Steps to Complete 2553 IRS from any online world linked gadget, customize it in line with your requirements, signal it electronically and distribute in different ways.

What people say about us

Filing digitally forms from home - important recommendations

Video instructions and help with filling out and completing Form Steps to Complete 2553 IRS