Award-winning PDF software

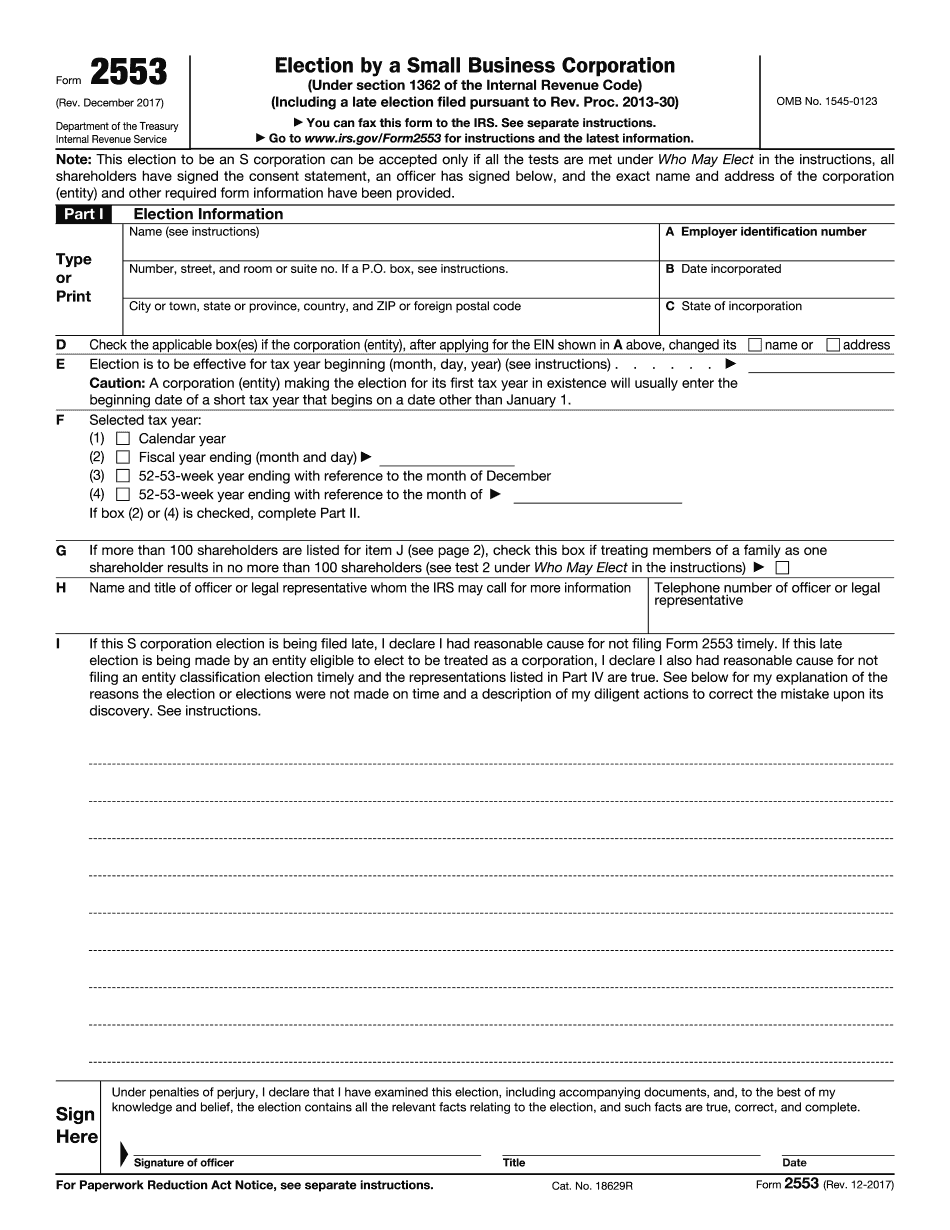

Form Steps to Complete 2553 IRS for Carlsbad California: What You Should Know

January 27, 2019. What to Pay Your Self-Employed Employee — Fund Era Sep 17, 2025 — All employee compensation you pay to your self-employed employee may be excluded from your personal income. The only exception is compensation paid because you are not actively engaged in the business. How to Pay Self-Employed Employee — Fund era Sep 21, 2025 — You should pay your self-employed employee the following amounts to the extent they are exempt from the self-employment tax. Your self-employed employee is exempt from Self-Employment Tax. Your unincorporated business must deduct all business expenses incurred by the business for which it is the owner or co-owner, other than the expenses your self-employed worker incurs. Unincorporated Business Exempt from Self-Employment Tax — Fund era Sep 22, 2025 — If you do not plan to withhold federal income tax from self-employment income because you receive more than 400 in compensation, you are not required to withhold (an additional 2.5% of) the wages, tips, or other compensation of you and your employee. You can deduct 10% of the unearned portion of such wages and tips, up to the amount of income tax you are required to charge due to the self-employment tax. Exemptions: Employee Compensation. Payments for services not covered by the Employee Compensation Protection Act of 1993 (CPA) (Exemption) — Fund era Oct 28, 2025 — Learn all your options for making federal income tax withholding without having to send your employee an employee withholding statement. IRS Tax Forms You Can Get From Other Entities Oct 28, 2025 — The IRS issues a range of forms commonly called IRS Form W-2, 1099-MISC, etc. to businesses. Learn more about those forms here. How to Create Business Entities Nov 3, 2025 — Learn how to create the necessary legal, financial and administrative controls for your business. Forms Required by U.S. Taxation Vol. 32, No. 7, November 2008, pp.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Steps to Complete 2553 IRS for Carlsbad California, keep away from glitches and furnish it inside a timely method:

How to complete a Form Steps to Complete 2553 IRS for Carlsbad California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Steps to Complete 2553 IRS for Carlsbad California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Steps to Complete 2553 IRS for Carlsbad California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.