Award-winning PDF software

Form Steps to Complete 2553 IRS for Chico California: What You Should Know

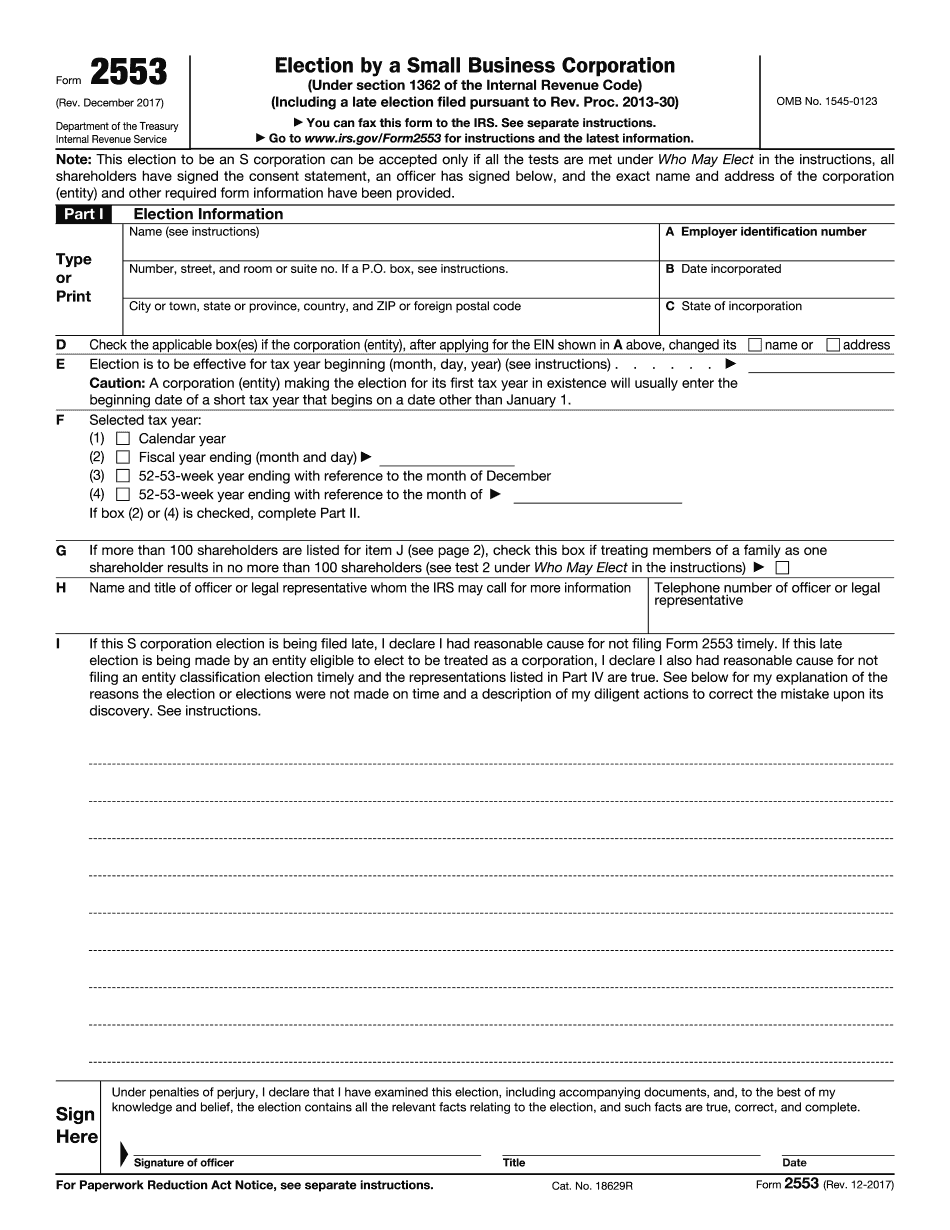

Who is an S Corporation: A look at Form 2553 in the United States and Canada. The federal tax law applies to all incorporated business entities unless otherwise noted. The IRS describes S Corporations and LCS in general terms or includes them in their Tax Guide. We provide the necessary information for individuals to understand the difference. The U.S. Treasury Department uses Form 2553 and Form 8869 to control the ownership of corporations that are subject to taxes. The IRS describes S Corporations, or Limited Liability Companies, as a type of domestic or foreign limited liability partnership.” Corporations generally pay the lower corporate tax rate — as low as 35% — in the U.S. The IRS has the authority to determine what types of businesses have a limited liability for tax. A limited liability company may be exempt from U.S. income tax under the laws of a state. Business owners may, however, be required to pay corporate tax on their income in some states if they do not have proper franchise laws to operate as a corporation. The IRS treats each state separately. The maximum tax liability for the current tax year for corporations is 25,000—the income of the corporation that was not taxed to the owners. Under current IRS rules, businesses that file Form 2553 for the first time are required to file quarterly reports. These quarterly reports show the total of all income of the entity; if the total income is more than 5,000, the IRS will also require the business to submit the annual gross income and all federal taxes payable on that amount. (In some cases, this income may be required to be filed as a Schedule E.) What is an S Corporation: Form 1125 — IRS Tax ability, Election and Loss Treatment — When — and How? What is an S Corporation: Form 1125 — Corporations Tax Guide. Tax ability, Election and Loss Treatment. When is an S Corporation Not Generally Taxed by the U.S.? A Form 1125 is for a tax that exists on S corporations, and the federal tax law applies, for other corporations. The law of some states has also changed. These states treat a Form 1125 as a separate tax for S corporations. When Should I File an S Corporation Returns? If you have a corporate structure, you should file Schedule C to report your corporation's income and payments to you and your shareholders.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Steps to Complete 2553 IRS for Chico California, keep away from glitches and furnish it inside a timely method:

How to complete a Form Steps to Complete 2553 IRS for Chico California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Steps to Complete 2553 IRS for Chico California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Steps to Complete 2553 IRS for Chico California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.