Award-winning PDF software

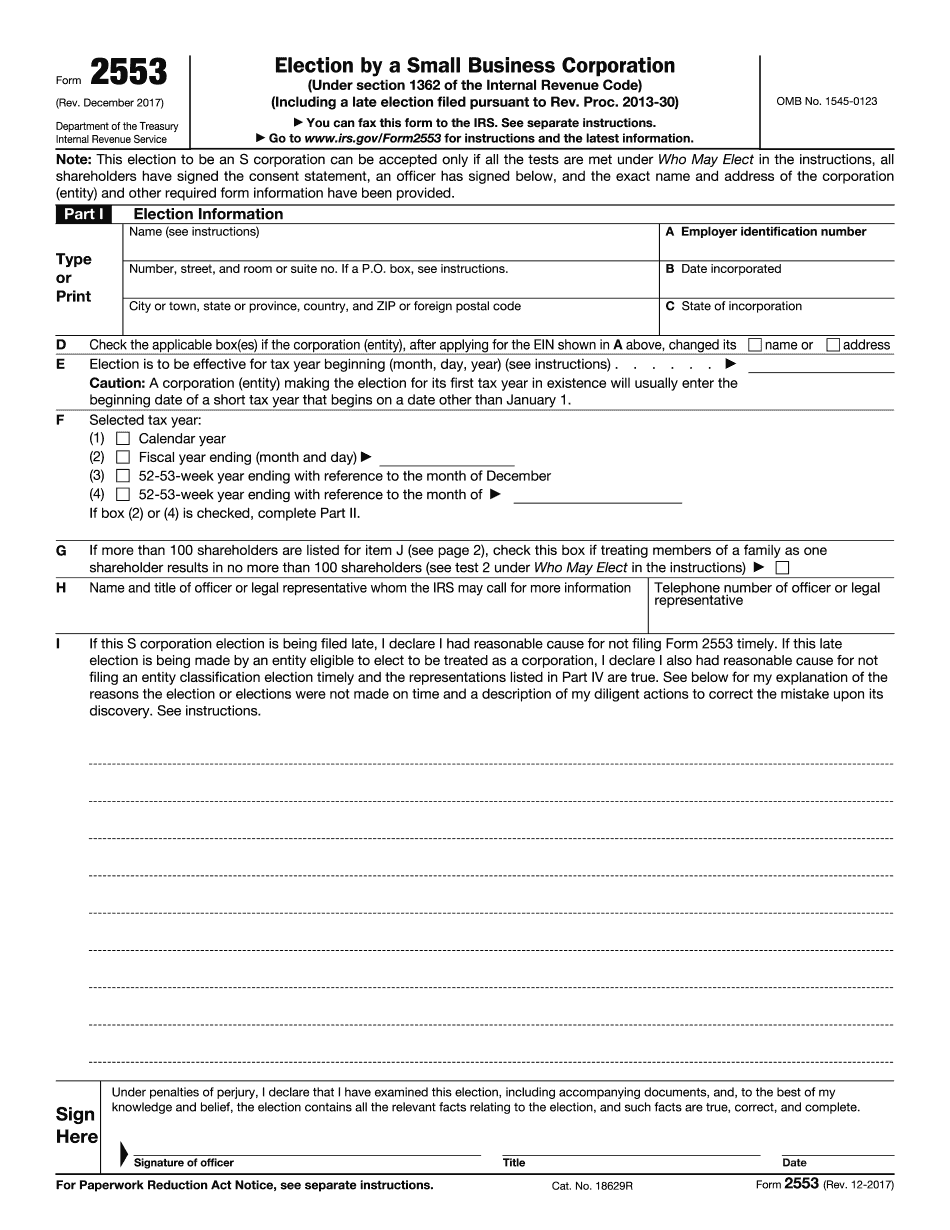

Form Steps to Complete 2553 IRS online Riverside California: What You Should Know

Filing the Tax Return with the Internal Revenue Service The tax return should reflect the amount of business income and income tax paid. Form 2350: U.S. Individual Income Tax Return Form 2350 provides information that is critical to the preparation and filing of individual income tax returns. This form is used by each of the 50 states to receive and process individual returns. Federal forms are available through the IRS. All states have passed laws to use Form 2350 to prepare their own individual income tax returns. What to Expect While preparing your tax return All taxpayers must ensure that they provide the information and documents requested on the form in an accurate and complete manner. Failure to do so could result in a late return, penalties, and/or tax liability that could greatly reduce your taxable income. Form 2468: Federal Unemployment Tax Return (Form 2468) On this page is needed the information for preparing Form 2468 under the Internal Revenue Code. The IRS will send you Form 2468 as instructions on how to fill out and mail Form 2847: Form 1411, Other Than Qualified Debit Card Election Under Sec. 1381, or Other Than Qualified Debit Card Election Under Sec. 1382, in which it is necessary to file. This is your choice for filing Form 1411 or 1381 by which you are voting to change your election from receiving qualified debit cards. This also applies if you want to receive a Form 6166 as a Form 1381 election, and it requires payment of a Form 1098 for you, your spouse, or an individual under 18 years of age. Form 2847 is a Form of election that you can use if you are changing the amount you are receiving from receiving qualified debit (e.g., a MasterCard, Visa, Discover, or American Express) cards, and you do not want to become subject to the 25% withholding tax imposed under Sec. 7805. Form 2847 is used to change your election to get qualified debit cards in order for you to be allowed to receive such cards without further taxes. What to expect while your Forms 2847 is received by the IRS The form 2847 is delivered to you by the taxpayer as a PDF file via email or the mail that you are allowed to open and receive. You are only required to sign with a signature box. Note that if you are filing Form 8802, the IRS will deliver them directly to your office.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Steps to Complete 2553 IRS online Riverside California, keep away from glitches and furnish it inside a timely method:

How to complete a Form Steps to Complete 2553 IRS online Riverside California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Steps to Complete 2553 IRS online Riverside California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Steps to Complete 2553 IRS online Riverside California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.