Form 2553 (Election by a Small Business Corporation) 2025

Show details

Hide details

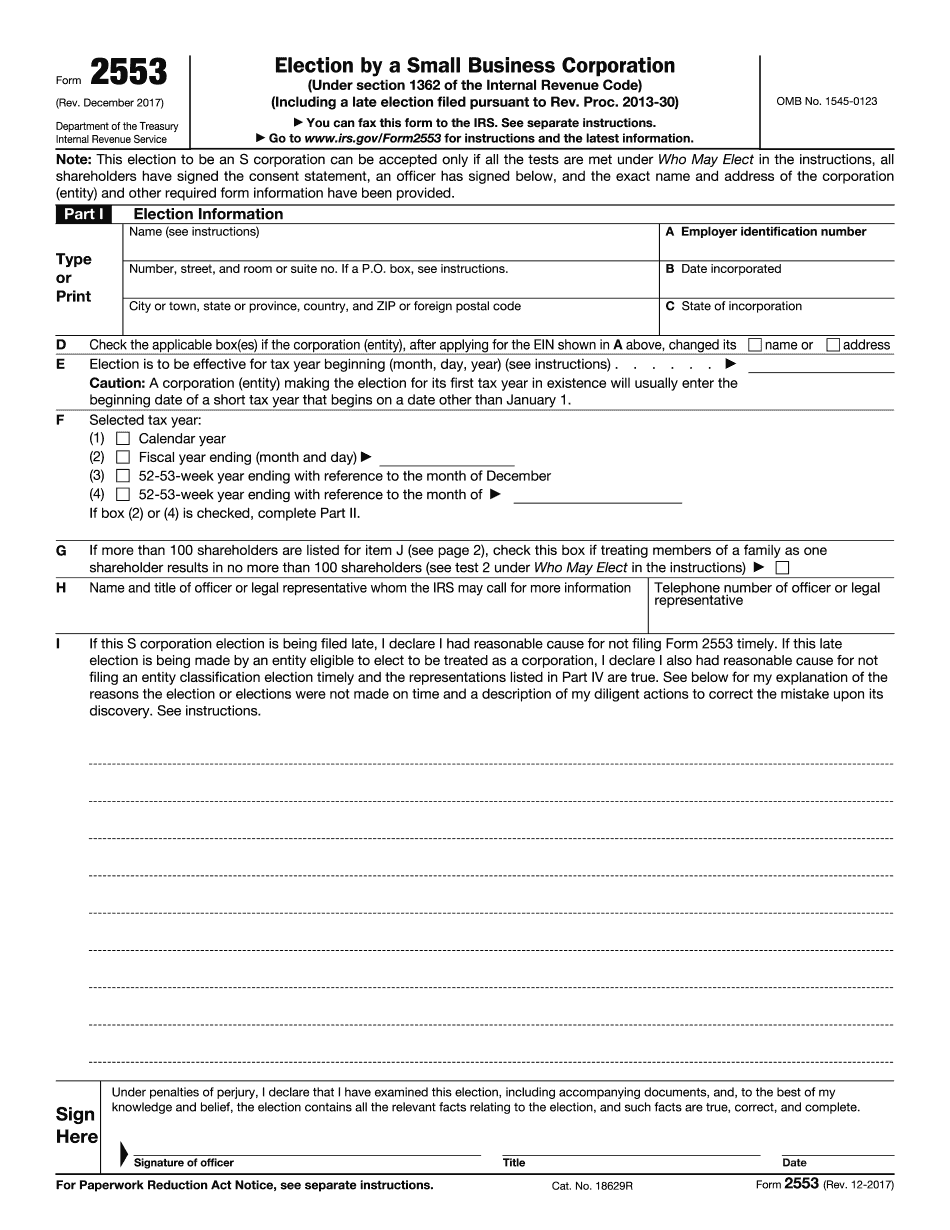

Ices necessary to establish a business purpose. Name or address If more than 100 shareholders are listed for item J see page 2 check this box if treating members of a family as one shareholder results in no more than 100 shareholders see test 2 under Who May Elect in the instructions Name and title of officer or legal representative whom the IRS may call for more information Telephone number of officer or legal representative If this S corporation election is being filed late I declare I had ...

4.5 satisfied · 46 votes

irs-form-2553.com is not affiliated with IRS

Filling out Form Steps to Complete 2553 IRS online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to Form Steps To Complete 2553 IRS

Every citizen must report on their finances in a timely manner during tax season, providing information the Internal Revenue Service requires as accurately as possible. If you need to Form Steps To Complete 2553 IRS , our reliable and intuitive service is here at your disposal.

Make the following steps to Form Steps To Complete 2553 IRS quickly and accurately:

- 01Upload our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official instructions (if available) for your form fill-out and precisely provide all information requested in their appropriate fields.

- 03Complete your document using the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the tool pane above.

- 05Use the Highlight option to stress particular details and Erase if something is not applicable anymore.

- 06Click the page arrangements key on the left to rotate or delete unnecessary file sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your report from our editor or select Mail by USPS to request postal report delivery.

Opt for the most efficient way to Form Steps To Complete 2553 IRS and declare your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

Watch our video guide to learn how to prepare Form Steps to Complete 2553 IRS

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form Steps to Complete 2553 IRS ?

There are specific IRS procedures to be followed when completing a Form W-8BEN as explained below.

Do your employer or the employer's agent(s) know the W-8BEN form number (Form 2553), Form 1099-INT, or Form 2555? If so, then you must complete Form 2553, include your employer's agent's email address on Form 2553, and ask that Form 2555 be sent to that agent's work address. Be sure to include the email address of the employer's agent on Form 2553. Note: Your employer's agent must have the ability to log into the Employer ID (EID) system of the U.S. Department of Labor and be able to view the employee's Form W-8BEN electronically before filing a Form 2553. Be advised that the EID system or system used by the employer does not allow a single user to see all Forms 1099-INT, (Einverkaufgebot) and 1099-INT-EIN, received. If your employer's agent is not able to see all Form 1099-INT and Form 1099-INT-EIN emails, please report this failure on a Form W-8BEN with the appropriate line item code and reason for failure. What does Form 2553 entail?

2553(a) (First) — Establish your name, date of birth, social security number, and employment and employer/employee relationship.

2553(b) (Second) — Identify and include all the following:

1. A description of each employee, or all employees under a single employment contract, on whom you furnished fringe benefits in any calendar year during the period ending on or before the date of any transfer of an employee, or to whom you furnished any fringe benefits. Include each name, birthdate, social security number, and the year in which they were employed, but do not provide any date or amount of remuneration from time to time.

2. A statement of your employment relationship with each employee. Make certain that the statement adequately describes the services that each employee received.

3. A statement of all reimbursements or payments to which you are entitled.

2553(c) (Third) — Establish the employee's work or nonexempt, unpaid family share of all tips or gratuities received.

Who should complete Form Steps to Complete 2553 IRS ?

This is a tax return summary form that is useful when you do not expect to file your entire tax return. Entering Schedule C, Schedule D, Schedule E, or Form 1040 is not necessary for filing Form 2553. Use the steps to complete Form 2553 to file Form 2553 electronically.

Use Form 2553 for the following purposes: Prepare Form 2553 for filing electronically

Submit Form 2553 online

Filing an Income Tax Return For information on preparing and filing an individual income tax return, see IRS Circular 230, Using Free Software to Prepare and File Your Return.

Note : When you prepare Form 2553 electronically, you are not required to enter the instructions for Schedule A in addition to the steps to complete Schedule C.

Prepare Form 2553 for filing electronically Complete and sign the completed Form 2553, Return to Self, unless you have a signed election.

Complete and sign the completed Form 2553.

Sign and date the Form 2553.

Mail Form 2553 to the location listed in the instructions. Use IRS mailing addresses for forms and instructions. Use any other address your business uses for mailings for tax purposes.

Complete and sign the completed Form 2553.

Complete and sign the completed Form 2553.

Sign and date the Form 2553.

Mail Form 2553 to the location listed in the instructions. Use IRS mailing addresses for forms and instructions. Use any other address your business uses for mailings for tax purposes.

Complete and sign the completed Form 2553, Return to Self.

Filing an Affidavit of Support (Form 2555) For the following purposes, use the instructions for Form 2555 to prepare a declaration or other document on which you will include evidence of the support for the tax. If you are filing a joint return, and you do not require a declaration for yourself, use a separate document for your financial support. The type of document to use depends on your situation. For example, if you owe more than one tax, you may use Form 2555-A or 2555-B.

To receive a copy of Form 2555 or a summary of Form 2555, mail a Self-Employment Certificate (Form SS-10) with your completed Form 2555 to the address mentioned in the instructions.

Use paper Form 2555 forms and instructions to prepare any affidavit of support you will use to support the tax you owe.

When do I need to complete Form Steps to Complete 2553 IRS ?

In order to get a form from Form 2553, you need to fill out the entire form.

Can I create my own Form Steps to Complete 2553 IRS ?

Yes, you can use the steps provided if there are not any already available for your Form W-2. For more information, see IRS Guide 1005, General Instructions for Certain Information Returns. In addition, there are special handling instructions for Form W-2 that apply whether you are filing a modified return. If you want an extension to file your personal Form W-2 or to pay an additional tax, you can obtain a personal electronic filing extension online, or in person at an E-file Center. How do I prepare and file Form W-2? To prepare a Form W-2 with no filing deadline, go to IRS.gov or call. There are two types of Form W-2: a tax return and Form 1099-MISC If you have taxable gross income for 2018 that you report on Form 1040, 1040A, or 1040EZ, you have to attach Form 1099-MISC to the tax return online A2. If you also have taxable gross income for 2018 you report on Form 1040A, 1040B, 1040C, or 1040D, you have to attach Form 1099-MISC to the tax return on line A, the line for Form 1040, or line D if filing a joint return. For more information, see Tax forms and schedules A, B, C, D, E, and F in chapter 3. The form you get with the Form W-2 is an electronic or paper return. You must print your Form 1099‑MISC when you prepare your Form W-2. You must attach the form to your tax return. If you get the form in paper form, use the Form 1099‑MISC line to make Schedule A to your tax return. A Form 1099‑MISC is not information you file with your return. If you owe a tax, you must return the Form 1099-MISC to the IRS no later than the date the taxpayer's tax return is filed. If you don't have to file a Form 1099‑MISC, you can attach it to your tax return on a computer disk, hard copy, or by mailing a copy to the address on the form. Form 1099‑MISC must be completed with a valid Social Security number, employer identification number (EIN), and date of birth.

What should I do with Form Steps to Complete 2553 IRS when it’s complete?

Enter your Form 8283 to complete your tax return. If you have any additional questions on a particular form or if you have any other tax-related questions, contact the nearest U.S.

How do I get my Form Steps to Complete 2553 IRS ?

How do I get my Form Steps to Complete 2553 IRS :

The form steps 2553 IRS must be completed by your taxpayer. It is a detailed report.

Download Form 2553 and its instructions to your computer.

Complete a sample Form 2553 that has four sample forms (Form 2553A, 2553B, 2553C and 2553D). These are just sample form, and you also use them to practice Form 2553 procedures.

Get a printed copy of Form 2553 and complete the paper work on line 1-4.

Suspend your right to file by not filing Form 2553 due to a failure to obtain a Form 2553. You need to file this form if: You do not expect to take responsibility for the return, or you are not the original taxpayer or the person to whom Form 2553 was written.

Due to another event, you cannot reasonably be expected to make a timely filing of Form 2553. However, you can file Form 2553 if: You have to file a return on a timely basis, but you are not responsible for the return.

You have to file a return on a timely basis if: You may be able to resolve the issue with your client and file later than due date. If you file late, you must file with an extra 100 penalties.

You cannot reasonably be expected to file on a timely basis, and you have sufficient personal funds, or

You fail to follow the procedures for claiming a taxpayer identification number. If one is required, you must complete Form 2565 and attach a statement to the form and all returns, showing you have received instructions and have filed their returns by their due date. The statement should clearly identify the taxpayer or taxpayers. Do I have to complete the entire Form 2553 if a single Form 2553A, 2553B, 2553C and 2553D are attached?

There is no special rule with regard to Form 2553A, 2553B, 2553C and 2553D.

How do I use Form 2553?

Form 2553 should be used when: You are not required to file this individual return. You must file Form 2553 to determine if you are responsible for the tax due. You must make repairs, repairs, or improvements to the property or business, or you have insurance coverage for this work.

What documents do I need to attach to my Form Steps to Complete 2553 IRS ?

What documents do I need to attach to my Form W-2?

What is a W-2 and how many can be produced?

What is an IRS Form W-2?

What is Form W-3?

What is Form W-4?

What information is included in the Federal Taxpayer Identification Number on the IRS Form W-2?

What is the Form 941, Federal Income Tax Return with Estimate?

How is a return created for an individual who filed two or more returns during the tax year?

Is there an option to check whether a taxpayer reported income from property other than his or her principal residence?

What is the purpose of Form 944, Request for Return of Certain Property Held for Tax Purposes?

Is there an option to indicate the date of receipt of an IRS form?

What is Form 945, Income Tax Return from Alien Subject to U.S. Income Tax?

Taxpayers who paid taxes to foreign entities, or those claiming a foreign tax credit, will receive an error message stating incorrect currency and need to correct in the field where they would have entered.

Do I have to file a U.S. Income Tax Return?

No, you do not have to file a U.S. income tax return. If paid in full, a U.S. income tax return is free. If not paid in full, you need to file form 5471, U.S. Tax Certificate of Withholding, with the IRS. Learn more about filing your tax return.

For more information on Form 1040, Use Your U.S. Income Tax Return and Payment Options, visit IRS.gov/Forms.

Is a joint return considered a combined return?

In most cases, a joint return and a separate U.S. income tax return are identical. However, if you claimed both a foreign earned income exclusion and a foreign housing exclusion in a specific tax year, you can claim the foreign housing exclusion on your combined U.S. income tax return and your foreign earned income exclusion on your separate U.S. income tax return.

To determine whether a year-to-date balance on a Form 1040 is a joint return, all the combined taxable income from all sources on the same date will have to be added together and divided by the number of U.S.

What are the different types of Form Steps to Complete 2553 IRS ?

We have compiled our comprehensive list to help you determine how to best complete 1523 IRS, Form 2553 (T4c), as well as Form 2553 (T4b). Each of these forms is designed to help ensure that your employment income has been accurately reported to the Canada Revenue Agency if you have a non-U.S. employer. These forms are also useful where you have multiple employers, and you work regularly at least 35 hours per week and have no more than 15 foreign earned income (FIE).

Who is Required to Complete Form 2553 (T4c)? Form 2553 (T4c) is a T4 that must be submitted by your employer if: your employment income as a resident of Canada is 10,000 or less, and.

You have more than 75% of your employment income as a resident of Canada deducted and reported.

How Many Days is There Between Cashing In and Receiving Form 2553 (T4c)? This form is to be filed no later than the day on which you cash in your employment earnings, and.

You must pay the tax due the next pay day.

For further information

See Guide T4041, Employer's Guide — Filing the Canada Pension Plan (CPP), 2017, for more information about the CPP.

Note You should always keep any forms and agreements from your employer. They can help you to avoid the penalties for under-reporting employment income or the income tax consequences for failure to file forms that are not filed by employers. The Canada Government has the information you need to file a tax return from abroad (including foreign income tax returns and foreign tax credit returns). If you need further information on Form 2553 for a foreign employer, you can get it from the Canada Revenue Agency's foreign service. Or, a tax advisor at your tax planning center can help with your tax return. If you need a list of Canada's tax treaties and conventions for tax treaty purposes, you can read about tax treaties and conventions on the Canada Revenue Agency's website.

Contact Information for Other Countries Where You File a U.S. Tax Return

Note While the list provided here is intended to help you determine the most important countries where you can file a U.S. tax return, certain countries do not have tax treaties with the U.S., and as a result, Canada or Mexico may apply tax to the earnings or property of U.S. taxpayers.

How many people fill out Form Steps to Complete 2553 IRS each year?

Answer: 1 out of every 100. If your spouse doesn't fill out Form 2746 (which is more onerous), it can take your total tax burden into the 70% bracket. If you're in the 45% tax bracket now, you could be in the 45% tax bracket in 2040.

Do You Know Where Your Income Tax Will Be in 2040? What if someone is asking you about income tax in 2040?

The amount you earn each year may change every year. The IRS sets rates annually, but it could be lowed or higher during that year, then it could go up again in the next. At the end of 2025, you can expect your tax rate will be close to the one you'll face when you file your tax return in 2040. Your income and savings could be significantly better than they are today, but depending on how you decide to invest your life away during those years, it could also take a different path — a less stressful one.

Do You Know Where Your Income Tax Will Be in 2040? If you're looking for guidance from the tax experts, we might be able to assist you with your tax questions, and we'll look forward to hearing from you. Find out how to get a Free 1040 Tax Return (Form 1040EZ) now, at the IRS. There are no fees, and it takes just a few minutes to get started!

You can use any of the free income tax apps to help you plan your tax return.

Download a free 1040 form from Get Transcript Now to be prepared for the changes in your income.

We also offer:

Earnings

Tax-Filing for Beginners

Prepare and file your tax returns using the tax software we use when we prepare our tax forms for all types of tax refunds and other taxes.

Is there a due date for Form Steps to Complete 2553 IRS ?

If so, the due date is the 15th day of the month following the month in which the return is filed. For example, if the 15th-day of July is the next month, the due date for Form 2553 would be the 15th day of September. The due date can be found on a form with the IRS number. Examples of Form 2553-EZ, which shows the due dates for Form 2553, are available on the following Website.

IRS.gov/Forms2553-EZ

What should I do if I receive a tax lien on my car? If you received an IRS tax lien notice on your 2009 tax return, contact the IRS at the telephone number listed on your notice if you do not think the notice was fraudulent. You cannot legally fix the IRS notice with the DMV in the same way you would fix any other notice. You should send the notice to the address listed on Form 2553-EZ, which you received in the mail. Furthermore, you must provide the mailing address of the address you believe the IRS notice can be sent to. Furthermore, you may also be able to receive a refund of any taxes you paid on the date you received the notice, as long as you have filed your annual return by that date.

For more information about correcting this type of notice, see the following publication that helps you with tax liens.

IRS.gov/TaxLienForms.

What is the IRS mailing address? To obtain the mailing address for the IRS, contact this address:

U.S. Treasury

Office of Internal Revenue Operations

P.O. Box 587

Charlotte NC 28

If you receive a tax lien notice in the mail, do NOT add it to the tax filing schedule. The IRS does not care where you put a document. Mail the notice to the address given on the notice. If you file a paper return and the IRS has the mailing address for the last listed employer in the return, you will have to figure the correct amount to add to your tax return.

Is there a mailing address for tax-related correspondence from or to you? Yes. The IRS mail address is:

U.S.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here